Megan Koenig, DO, MBA, MS New Physicians in Practice Committee Chair

We are pleased to welcome guest blogger Megan Koenig, Chair of ACOEP’s New Physicians in Practice Committee, as she provides tips on maintaining and improving your credit score.

Once a year it is smart to request your credit reports in order to do an annual “cleaning” of your credit to make sure there are no errors/fraud. And it is definitely a good idea to request a report 2-3 months in advance of any large purchases. Even just a single point change in your credit score can mean the difference of thousands of dollars in decreased interest rates and fees such as PMI over the years, so it is well worth your time to make this an annual occurrence.

There are three companies who manage your credit score:

– Equifax

– Experian

– Trans Union

Keep in mind, there are various companies out there, including some credit card companies, who provide free services to check all three companies at once for you (www.annualcreditreport.com). However, these reports are generally not as comprehensive and detailed as the reports that come directly from the companies themselves at a more expensive price point. In general, for the typical annual review, I would stick to the free reports just to glance over for any glaring errors but only pay for the individual company fees if you find that you need to do more investigating on a specific discrepancy.

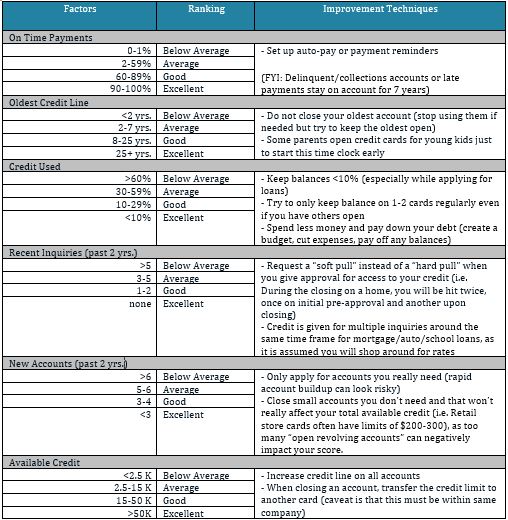

Each of the three companies calculates your credit score a little differently so there can actually be quite large variations in scores between them. However, the following items are consistently considered the main factors that influence your credit score no matter which company you choose, and the third column lists some ways to address these factors:

Remember, credit is your financial reputation. Like your character, it is built over a lifetime and can be ruined with just a few bad decisions. So keep a close eye on it and continue to build it one point at a time.

Sincerely,

Megan Koenig, DO, MBA, MS

NPIP Committee Chair